(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

World War 3 has already begun, whether the mainstream media and political elite wish to acknowledge it or not — it’s just not being fought using the same methods or in the same theatres of war as the last two. Instead, three nuclear superpowers (USA, Russia, and China) are sparring against each other on the physical battlefield through proxies (Ukraine), in cyberspace, in finance via sanctions, in semiconductors via virtual embargos, in space via satellites, and in mental health (largely via social media). Tick, tock…

In every war, the side that has won has always been the one that was able to most efficiently marshal resources towards its production of instruments of war. And given that everything produced by humanity depends on energy, all wars are won and lost on the availability of energy. Since WW2, that has meant hydrocarbons.

Don’t let the acolytes of Her Climate Royal Highness, Greta Thunberg, mislead you into thinking hydrocarbons such as oil, natural gas, and coal don’t matter. If these things didn’t matter, the Middle East wouldn’t be such a geopolitically important place, and small city-states would not be permitted to host the FIFA World Cup in 40-degree Celsius heat using air-conditioned mega-stadiums built with mostly imported foreign labour.

Given that we are in a global conflict, the question is, if there were some major disruption in the availability of hydrocarbons that caused their global price to double or triple overnight, how would the major powers wield their weapons of monetary policy in response? To that end, some of the superpowers at war (and their fair-weather friends) are major swing energy producers — so it’s safe to assume that energy would be weaponised to inflict damage on those who do not produce enough of it domestically. And building off that premise, as investors, our directive is to forecast how Bitcoin would respond to such a scenario — because Bitcoin is pure energy converted into a digital monetary instrument via the mining process.

For this essay I will focus on oil’s supply, demand, and price as a proxy for global energy. What would happen to the price of Bitcoin in the medium-term if oil ramped 2x to 3x overnight? To answer this question, we must guess at what the major global financial powers would do in response. The countries/economic blocs in question are the United States (US), European Union (EU), China, and Japan. Together, these territories account for a large percentage of the global economy — and more importantly, their central banks enact monetary policy that, in the aggregate, determine how loose or tight financial conditions are globally.

Here are a few examples of realistic potential situations that could cause a rapid rise in the price of oil:

1. Israel and/or Saudi Arabia decide to bomb a piece of critical infrastructure in Iran, and Iran finally decides to escalate by closing the Strait of Hormuz.

2. Russia, Saudi Arabia, and/or other large oil producers decide to materially reduce their production of oil.

3. Critical refineries and/or oil and gas pipelines are taken offline due to deliberate sabotage. (This has already happened to the vital natural gas Nord Stream I and II pipelines between Russia and Germany.)

Of all these hypothetical scenarios, the first one seems the most likely to occur at this stage. Given the news that Iran has recently reached 84% enrichment of uranium, it’s probably safe to assume that Israel and Saudi Arabia are currently assessing whether increased military action against the Iranians is warranted.

Primer on Global Oil Supply and Demand

Before we jump into the meat of the analysis, I want to set the stage with some useful information on the global oil market. I will be using the shorthand “mm b/d” to stand for a million barrels per day.

Hydrocarbons — i.e., crude oil and its refined products — are so important to modern life because they are so energy dense. For all the hype around electric vehicles, gasoline and diesel (which power the majority of global vehicles) are close to 100 times more energy dense than lithium-ion batteries. This is why breaking our addiction to hydrocarbons, if it ever happens, will take much longer and be much more expensive than is commonly expected. Oh, and by the way — guess what powers those charging stations? Natural gas and coal-fired power plants. You just can’t escape hydrocarbons.

Oil Playa’s Ball:

The US is the largest global producer and consumer of the sticky-icky. Given that all economic activity is energy transformed, it is no surprise the US is the world’s preeminent economic superpower. It doesn’t have to rely on importing a significant amount of the oil needed to power its economic juggernaut, giving it a leg up on some of its economic enemies. But if those foes could devise a means of becoming self-sufficient, they could threaten the US’s throne. That’s why the combination of cheap Russian energy with the manufacturing prowess of Germany and China petrifies the US political establishment — and it’s why a rapprochement between those three musketeers must be prevented at all costs. The most obvious risk to global oil supplies is a blockade of the Strait of Hormuz.

It would be relatively trivial for Iran to disrupt the maritime flow of oil using anti-shipping mines and fast boats. At that point, the Emperor (US President Biden) would call upon House Harkonnen (the US Navy) to restore the flow of spice (ahem, oil). It would not be easy to restore flows because Iran would only need to damage a few civilian vessels to make passage through the strait uneconomical due to the elevated cost of maritime insurance (or potentially making it impossible to secure such insurance at all). The US, on the other hand, would need to deliver a knockout blow so firm that it restores global confidence that civilian commerce can continue with little to no risk. This is the definition of asymmetric warfare.

If the strait is blocked, the next question is whether it can be bypassed.

“The Strait of Hormuz is the world’s most important oil chokepoint because of the large volumes of oil that flow through the strait. In 2018, its daily oil flow averaged 21 million barrels per day (b/d), or the equivalent of about 21% of global petroleum liquids consumption…There are limited options to bypass the Strait of Hormuz. Only Saudi Arabia and the United Arab Emirates have pipelines that can ship crude oil outside the Persian Gulf and have the additional pipeline capacity to circumvent the Strait of Hormuz. At the end of 2018, the total available crude oil pipeline capacity from the two countries combined was estimated at 6.5 million b/d. In that year, 2.7 million b/d of crude oil moved through the pipelines, leaving about 3.8 million b/d of unused capacity that could have bypassed the strait.”

Source: EIA

To summarise, blocking the Strait of Hormuz removes approximately 17.3mm b/d from the global markets. Of that amount, only 3.8mm b/d can be rerouted via pipeline to the Red Sea, which leaves a net global deficit of 13.5mm b/d. That is approximately 13.6% of daily global demand, according to 2022 data from the EIA. The marginal barrel of oil which determines the last price would immediately become extremely expensive, as all other supplies would be spoken for. Woe be the nation that must bid in the spot market for that marginal barrel. Usually, it is the poorest flags that are most affected. We would likely see an outcome similar to how nations such as Pakistan experienced brownouts because they lacked the natural gas needed to generate electricity and couldn’t afford to pay whatever it took like the rich Europeans.

The US

Even though the US is the largest oil producing nation, they are still a net-energy importer. That means that US consumers pay the global price of oil. Also important is the fact that oil companies are private, for-profit companies, which are therefore free to sell their refined product to whoever will pay the most in the global market. The US does not have state-owned firms that must sell domestically first. Because the US consumer pays the global price, US foreign policy is very focused on securing a pliant Middle East via military force. Since I entered this universe in 1985, the US has fought two wars in Iraq, a war in Afghanistan, participated in a civil war in Syria, and generally offered overt and covert support to a variety of “moderate rebels” who have participated in armed conflict throughout the Middle East. A pan-Arab coalition of Middle Eastern nations focused on securing the highest price for their oil for the betterment of their citizens — rather than killing each other — is to be prevented at all costs.

If a major amount of oil is taken offline for whatever reason, the rise in price will directly affect US consumers. Thankfully, the US has ample reserves of untapped oil deposits should there arise the political and financial will to drill, baby, drill.

US Untapped (aka Proved) Energy Reserves

(all charts and info from the EIA)

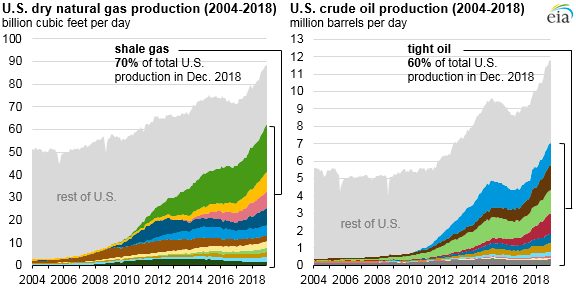

Year-end 2021 shale reserves: 393.8 trillion cubic feet

The US imports 2.8mm b/d from the global market. If the US were able to bring 2.5% of its proven 41.2 billion barrels online, it would achieve a year’s worth of energy self-sufficiency. At that point, US politicians give zero fucks what happens over in Sand Land.

To take this thought experiment a bit further, what if the elite politicians were able to ride roughshod over the anti-drilling forces and go all in on energy production? Then, the US would become the swing energy producer of the world, supplanting Saudi Arabia. For a modern global civilisation that requires hydrocarbons to exist, that is an immense power. It begs the question of whether the US might actually welcome a closure of the Strait of Hormuz, as it does the following:

Knocks out the ability for Saudi Arabia to ship most of its oil to the global market — especially to its number one customer, China. US President Biden and Saudi Crown Prince MBS ain’t BFFs no more after Biden called Saudi Arabia a ‘pariah’.

Provides the political cover to restart extensive domestic oil drilling in the US — which, as I will subsequently argue, allows the Fed to start printing money again.

Cements the US as the global swing producer of oil, which gives the US immense global power over the price of energy. Such power would remove the need for the US to undertake far-flung military options to suppress its foes. Instead, the President could play “Red Light / Green Light” with the supply of oil to certain countries, enabling the US to force compliance with American diktats.

And so, as the not-so-covert operations of Israel and Saudi Arabia against Iran ratchet higher in the wake of Iran’s increased uranium enrichment, there’s a chance the US might stand back and do nothing to stop the violence.

A quick aside on how rapidly the political opposition to drilling would disappear should the price of oil spike: the current US administration is trying to seem green by hamstringing the domestic energy industry’s ability to drill for more oil. But, look at what the current administration did in the Fall of 2022 facing 40-year-high inflation:

They dipped into the energy cookie jar and depleted the country’s strategic petroleum reserves. That drove gasoline prices lower, which hit right as voters headed into the ballot box.

At some point, the reserve must be replenished, but that’s a problem for the next election cycle. Even if the government ends up covering their short at higher prices, the political issue of energy inflation right before a national election was mitigated … Mission Accomplished!

The point of this example is to show that the current crop of politicians is likely to allow their green credentials to wilt quickly if it means reducing the price of gas for their constituents. So, if oil supply in the global market suddenly shrinks, it means they’ll probably be willing to ditch policies which prevent additional drilling for oil.

Such a situation would make it more politically palatable to return to the well(s), but countries would also then run into the issue of needing to figure out how to pay for the additional CAPEX required for drilling. Drilling for oil is extremely capital intensive. Not only do you have to build the machinery and facilities to explore and then drill, but you also must continuously improve your methods to either find more oil fields or increase the efficiency of existing wells. That is why most of the companies that do such work are publicly listed companies. They can tap the deepest pools of global liquidity in the reserve currency of the world.

To estimate the magnitude of all public and private energy companies’ combined annual CAPEX, I calculated the total 2022 CAPEX for all constituents of the SPDR Energy ETF (XLE US), which came out to $89.47 billion. This ETF includes giants such as ExxonMobil and Chevron, two of the largest energy producers globally.

Given that the price of oil is extremely volatile, energy companies routinely resort to borrowing money to finance the stupendous amount of cash they must spend each year just to stay in the game. And therefore, when money is cheap (or even free), these companies can drill and pump more oil. That is one of the major reasons the US was able to dramatically increase its domestic production of oil via shale deposits from 2010 to 2020.

US shale production grew dramatically from 2010 to 2018. At the same time, US 10-year treasury yields were at their lowest in decades, and total US non-financial corporate debt outstanding doubled.

IMF Total US Outstanding Non-Financial Corporate Debt

US 10-Year Treasury Bond Yield

But when oil prices rise, the orthodox central banking playbook says to raise interest rates to cool demand, which lowers consumption of energy, and hopefully brings down prices. Global investors in US Treasuries (UST) count on the Fed to tighten policy to maintain the purchasing power of USTs vs. oil.

The problem in this wartime, high-oil-price scenario is that the only way the US is going to get more oil domestically is by encouraging domestic companies to raise CAPEX, which will necessitate higher borrowing. But, these companies cannot borrow affordably when interest rates are high and rising. And this is why I believe that the Fed would have to lower interest rates and loosen financial conditions in such a situation, even as the international price of oil rose. With cheaper money in plentiful supply, domestic US energy companies could provide the cheap energy the US needs in the face of diminished global supply. While the trained economists at the Fed might initially baulk at such a policy, the politics will trump whatever nonsense they learned at their elite universities. In wartime, the Central Bank does whatever the politics of the moment dictate, independence be damned.

The EU

EU member states like Italy and Germany might produce some bad ass cars (like Lambos and ‘rarris), but these sexy motor chariots can’t move without gas. The EU is woefully deficient in energy — so from their perspective, the green energy transition makes sense. However, wind and solar are just not consistent and cheap enough once you factor in all the externalities faced by the poor countries supplying the raw materials needed to build wind turbines and solar panels. Also, it’s not windy or sunny all the time.

For the purposes of this discussion, when I refer to the EU, I am not including the United Kingdom (UK) or Norway. This is important, and I will explain why shortly.

Europa provides some truly depressing statistics for our baguette- and cheese-eating friends.

In 2020, the EU imported roughly 10.2 mm b/d of oil. They must import that quantity because domestic production was only 0.43 mm b/d in the same year. The below chart outlines where the EU imported most of its oil from that year.

There are few major issues with the places from which the EU sources most of its energy. As we know, Russia has been cancelled, and the EU no longer makes direct purchases of Russian oil. But in 2020, Russia accounted for ~26% of all imports. That alone is a massive hole to fill — but it gets worse.

Let’s assume supplies from Saudi Arabia and Iraq are taken offline because they cannot ship the crude via the Strait of Hormuz and the pipeline to the Red Sea is full. That knocks out another ~15% of the EU’s imports. So, taken together, the war with Russia and Middle Eastern disruptions would combine to knock out a little over 40% of total EU oil imports.

Putting our common sense caps on for a minute — a piece of apparel I know is currently in short supply in Brussels — the EU in this situation would become very dependent at the margin on its “allies” (i.e., Norway, the US, and the UK). The reason I lump these three in one group is because they are all culturally similar (all are majority Judeo-Christian derivative societies), and they are all members of NATO.

Norway has the capacity to pump a lot more oil into the EU if the EU is willing to pay for it. As I described above, the US has a vast amount of untapped proven oil reserves whose output could be sold on the global market at “mates’ rates” to their allies. And finally, the UK’s Oil and Gas Authority estimates that the North Sea contains between 10 to 20 billion barrels of oil. All that is needed is for the politicians to allow the major energy companies of each of these countries to explore, develop, and pump this oil.

Source: UK Oil and Gas Authority

The EU doesn’t have much in the way of untapped proven oil reserves that are just waiting to be commercialised. Therefore, the political question is twofold: first, will the EU restore friendly relations with Russia in order to resume their oil imports? And second, if EU/Russian relations continue to sour, how will the EU pay for increased energy from Norway, the US, and the UK, all of whom are outside of the EU’s currency union?

I have some assumptions. Given the current political rhetoric of the elites in charge of the EU, I don’t believe they can return to the warm, energy-filled bear hug of President Putin, even if the war in Ukraine ends immediately. The US would not allow it (Pulitzer Prize winning journalist Seymour Hersh alleges the US and Norway deliberately sabotaged the Nord Stream I and II pipelines to cement Europe’s energy dependence on its supposed Western “allies”), and EU politicians are not typically willing to go against Washington’s wishes. In addition, EU politicians are likely unwilling to stomach a large-scale curtailing of the bloc’s energy usage — particularly one large enough to offset the removal of Russian and Middle Eastern crude oil, since such a significant reduction in energy usage would inevitably be accompanied by a double-digit economic crash. Just look at how EU politicians have already resorted to handing out energy goodie bags to their voters to shield them from the rising cost of all forms of energy, rather than requiring them to make hard sacrifices.

Given the above, my belief is that the ECB will be called upon to print EUR, which can then be used to pay for increased imports of Norwegian, US, and UK oil. But, I also think that those three countries will not be so generous as to accept EUR for their oil. It’s a trash currency from a region with no population growth, expensive and unproductive labour, and no energy. Instead, I expect they will require the ECB to print EUR, sell the EUR for USD in the global FX markets, and then pay for the oil. This would weaken the EUR vs. the USD, which would be bad in the sense that imported energy costs would rise for the EU, but would be good in the sense that a weaker EUR would cheapen EU goods’ exports.

In addition, to help finance the Western energy companies supplying them with oil, the ECB will likely use some of its newly printed EUR to purchase those companies’ equity and debt — enabling the companies to increase CAPEX and pump more oil. Of course, printing money doesn’t solve the root issue of a lack of domestic energy supplies. But, if EU politicians are unwilling to re-engage with Russia and improve their relationships with their non-aligned former colonies, then the EU’s only choice will be to get pummelled by their Western “allies” and pay for the privilege with printed fiat money.

Japan

Japan is just fucked. They import almost 90% of their energy needs. Sadly, according to the EIA, as of 2020 Japan had only 44 million barrels of domestic proven oil reserves. The best Japan can do is restart all of its nuclear reactors, but even that won’t be enough to shield the land of the setting sun from the impacts of super-duper expensive hydrocarbons.

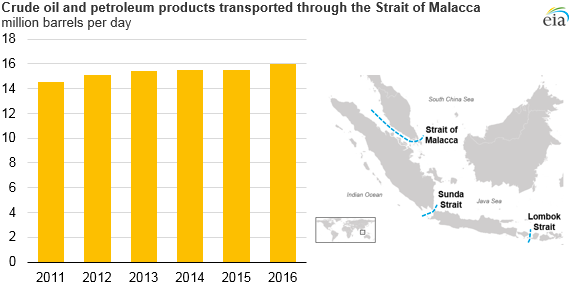

Data from METI paints a bleak picture of Japan’s oil supply concentration risk. In January 2023, Japan imported 94.4% of its oil from the Middle East, which was 2.57mm b/d. If shipping said oil is not possible due to a closure of the Strait of Hormuz and/or the Strait of Malacca, only two countries can feasibly bridge the gap due to Japan’s geographic location: Russia and the US.

Even though Japan fully supports the US in its proxy war against Russia, its lack of energy necessitated resuming purchases of “dirty” Putin oil in January of this year. Unfortunately, that only amounted to 0.02mm b/d, or 0.9% of its total monthly oil imports. In a pinch, Russia won’t be able to be the swing producer for both Japan and China. This means that Japan would be fully reliant on remaining in the good graces of the US in order to replace its Middle Eastern supply. As I mentioned earlier, the US has plenty of spare proven oil reserves to supply … at the right price.

So, where oh where shall Japan get the money to pay for US oil?

The BOJ has a money printer, and they definitely aren’t afraid to use it. The BOJ can pay for its American oil in two ways. First, the central bank can help fund the expansion of US oil production by using its printed Yen to invest in equity and/or the debt of US energy companies. And second, the BOJ must also continue manipulating the price of Japanese Government Bonds (JGB) so that the Ministry of Finance can afford to pay its ballooning USD oil import bill.

The most natural way to pay for imports from a particular country is to have exports to the same destination. But, “reshoring” is the new trend. Companies and governments don’t want far-flung supply chains. They are willing to bring manufacturing production back home and hand power back to labour. Remember — US President Biden is a staunch supporter of unionised labour. That means there is less opportunity for Japan to sell the US goods in order to pay for oil. Printing money is the only way. This logic applies to Europe as well.

The US don’t take no EUR, nor JPY. That means the Yen will continue to weaken against the USD, and freshly printed Yen will be sold for USD in order to pay for oil.

China

There are no easy answers for China. They don’t have much domestic untapped energy reserves. According to a 2021 SCMP article, China had only 280.7 million barrels of additional proven oil reserves as of 2017. They are very reliant on Middle Eastern oil shipped through the Strait of Hormuz and the Strait of Malacca. They are at war with the US and therefore cannot expect any help from the US or its allies. And building overland pipelines from either the Middle East or Russia takes time, and these pipelines must cross through a variety of other nations who may throw up obstacles to obstruct said pipelines’ safe completion.

“Nearly one-third of the 61% of total global petroleum and other liquids production that moved on maritime routes in 2015 transited the Strait of Malacca, the second-largest oil trade chokepoint in the world after the Strait of Hormuz. Petroleum and other liquids transiting the Strait of Malacca increased for the fourth time in the past five years in 2016, reaching 16 million barrels per day (b/d).”

Source: EIA Today in Energy, 2017

The EIA estimates China’s oil consumption averaged 14.76mm b/d in 2021. China domestically pumps 4.0mm b/d, which means they must import 10.76mm b/d. China unfortunately receives most of these oil imports via sea — primarily through the Strait of Malacca, which I talked about above. China desperately needs to diversify its oil supplies away from maritime delivery to delivery via overland pipeline.

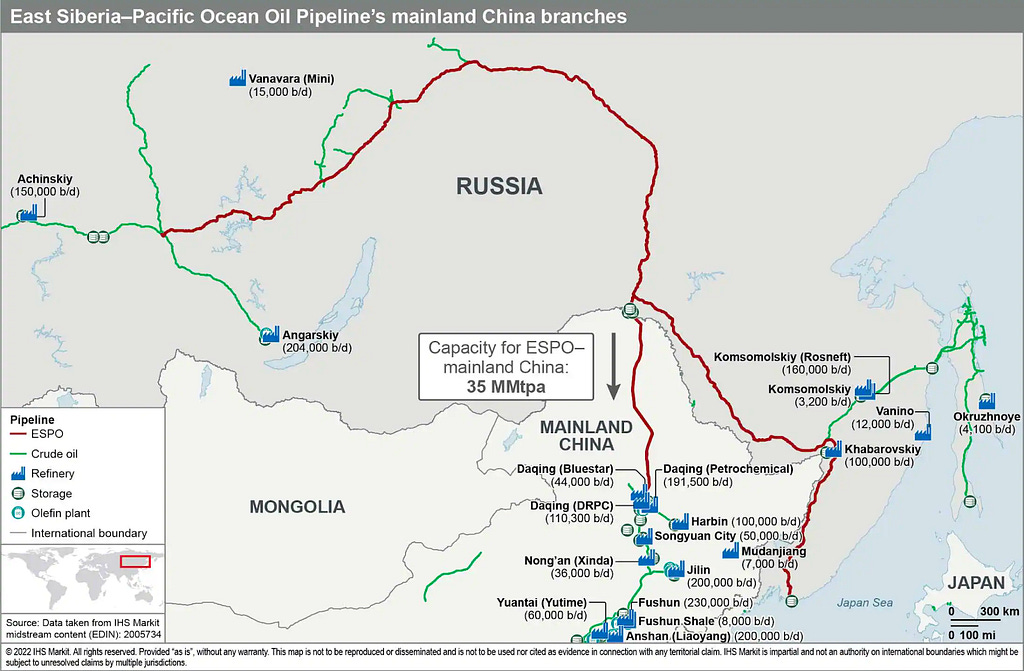

Currently, there are two major pipelines (Atasu-Alashankou and ESPO) connecting China and Russia. Combined, approximately 1.273mm b/d can transit through these pipelines into refineries in China. (The stated total capacity of the two pipelines is 55 MMtpa, which I converted to a mm b/d equivalent.)

Below is some scary arithmetic for the Party:

The US Navy’s bread and butter is patrolling sea lanes. It would be relatively trivial for the US to shut the Strait of Malacca. On paper, Singapore is a neutral country, friends with both China and the US. However, Singapore purchased over $27.4 billion worth of American weapons from 2017 to 2021. It remains an open question how Singapore would respond to any provocative actions in the strait if they originated from the country responsible for supplying its military hardware.

Reality dictates that, in the face of higher energy prices, China would need to dramatically reduce its energy consumption while building more overland pipelines to Central Asian energy producers. Telling your plebes to curtail their lifestyles in order to save energy is not an easy conversation. No Western politicians have been able to pull it off successfully — just look at how quickly so-called climate-focused politicians in the West resorted to coal, nuclear, and wood burning to keep their people from having to make hard sacrifices when they stopped buying Russian energy.

That said, the Chinese Communist Party (CCP) just demonstrated they are perfectly willing to place immense hardship on their comrades because … well, because the government said so. Remember the Zero-COVID policy of 2020 to 2022? The CCP locked down a country of 1.4 billion people in service to a policy which everyone knew would never prevent the spread of a highly transmissible virus. Xi Jinping expended enormous political capital to maintain said policy, and was willing to target outright economic contraction to achieve his goal. This begs the question: was Zero-COVID just a dress rehearsal for a longer lock down in the near future, as WW3 escalates and energy must be conserved?

If China needed to dramatically slow its economic growth to buy itself time to shore up its energy supplies, the Party would likely be perfectly willing to execute said policy. Given that Chinese growth is debt-financed, the PBOC would be called upon to tighten financial conditions. In this scenario, I would expect interest rates to rise and credit to tighten materially. Any available credit would be funnelled to firms that could help build infrastructure to pipe Middle Eastern and Russian oil into China. Chinese state-owned energy firms would also be called upon to use their expertise to help the Russians upgrade their current and planned oil wells. After the Ukraine war broke out last year, many Western oil and gas services companies left Russia. Russia became very dependent on China’s knowhow to elevate its production to levels not seen since the fall of the Soviet Union in 1989.

Revelations

I learn so much when I write these essays. I started out with the opinion that the US would suit up and inflict pain on Iran should they close the Strait of Hormuz. But after conducting the research for this article, I now believe that a severe contraction in the supply of Middle Eastern oil to the world would disproportionately benefit the US.

The US and its unofficial colony, Canada, currently supply 26% of the world’s oil. The US has a vast amount of untapped proven oil reserves just waiting to be liberated by a drill bit. If the tension in the Middle East boiled over into outright conflict, the US could in short order become the world’s most powerful and plentiful crude oil swing producer without having to fire a single bullet or Tomahawk cruise missile.

There just isn’t enough oil in the world that is easily and profitably accessible aside from in North America. As a result, the EU and Japan would have no choice but to prostrate themselves financially by printing money to buy whatever oil the US would give them. All three countries/economic blocs would need to reduce the cost of money in order to either produce or consume more oil. Only the PBOC would have to tighten monetary conditions, because the US would not bail China out of its energy shortage when they are at war.

With the EU and Japan firmly on-side vis-a-vis US foreign policy, an integration of the Eurasian landmass can be stymied. The manufacturing knowhow of Europe cannot access the cheap energy of Central Asia, and Japan hems in Russia and China from a naval perspective, denying them both access to the deep blue sea (i.e., the Pacific Ocean).

Four Square

TL;DR — if energy suddenly became much harder to come by and prices rose dramatically as a result, we could expect each country to respond as follows:

US — goes from tightening to loosening monetary policy

EU — goes from tightening to loosening monetary policy

BOJ — no change to current loose monetary policy

POBC — goes from loosening to tightening monetary policy

On balance, the net outcome in the face of an energy shock would be a global loosening of monetary policy.

Back to Bitcoin

As the hardest form of money ever created, Bitcoin will likely respond positively to looser global monetary conditions. As the amount of fiat money rises alongside inflation for the plebes of the world, monetary instruments with a fixed supply — like Bitcoin — by definition become more valuable in fiat money terms.

That is quite easy to see, but remember — the Bitcoin network also requires energy to operate. Miners expend energy to validate transactions. If global energy prices are rising, this becomes more expensive. Will countries allow Bitcoin miners to continue to use cheap power, or will they requisition said energy resources because times are tough? At the margin, I believe many countries who net consume energy will pressure utilities to either jettison miners or charge them a lot more for electricity. Say bye bye to cheap hydro in Nordic countries, the US, and Canada.

That’s only one side of the story, though. There are still many net-energy producing countries that may want to continue producing the same amount of energy, but for a variety of reasons, cease supplying said energy to the world market. For example, stopping and starting oil and well production is expensive because of the required cleaning and prepping of equipment, and build-ups of gases can also permanently impair wells. This means there is no easy “on/off” switch for an oil well. In many cases, it is better to just pump at full capacity at all times. Bitcoin is the perfect way to store said energy, because mining is purely a function of consuming electricity powered by whatever is the cheapest form of energy available. Anecdotally, I know a wealthy Indonesian family that owns large, coal-fired power plants and “saves” excess power produced in the form of mined Bitcoin. Many months back when I last spoke to the patriarch, he claimed they represented close to 5% of global hash power.

How Many Barrels of Oil Can One Bitcoin Purchase

Bitcoin trades globally and has grown its energy purchasing power over time, as the above chart illustrates.

Miners in the West could be forced to move to non-aligned countries that are producing much more energy than they wish to export. But, it doesn’t necessarily spell the end for Bitcoin if many of the large, publicly-listed miners must find new places to operate. Similar to how the ban on mining in China just meant more mining in the US, Canada, and Europe, a ban on mining in the US, Canada, and Europe could mean more mining in Venezuela, Angola, and Algeria.

The Trade Setup

Even if you agree with my arguments, it doesn’t mean the price of Bitcoin is going to behave positively immediately following an oil price spike. The global investing public will react extremely negatively to such a situation, because it points to a major escalation in the global conflict. When countries lack access to cheap energy, they show no qualms about using military might to take it from someone else — and war is not a good thing for financial markets. I would expect a correlation 1 moment, in which all risky assets — including Bitcoin — get rugged at the same time.

But after that, I believe countries’ monetary policy response will quickly start to differ from what textbooks say should happen (i.e., monetary conditions will loosen, rather than tighten). This will happen very rapidly — and therefore, assuming my hypothesis is correct, I do not expect Bitcoin to stay down for long. In fact, I expect Bitcoin will re-emerge as non-correlated to general equity prices. The elevated global liquidity will be targeted very specifically at increasing energy production, and Bitcoin has proven itself to increase in energy purchasing power over time.

The point of this essay is to provide a mental framework for a situation that occurs frequently during wartime — a lack of affordable energy — so that if such an energy price spike happens and you need to move your money quickly, you at least have a theory to fall back on. You can measure current events and market response against your hypothesis, and any deviations can then help inform a thoughtful response to the fast-moving markets. The worst thing you can do is jump to the first conclusion bandied about by the mainstream financial press trying to tell you how to think about the oil price spike. Usually, the market’s initial reaction is the result of conclusions drawn from simplistic analysis, but this reaction is typically proven wrong in the medium- and long-term as the second-, third-, and fourth-order consequences become apparent.

The longer WW3 persists, the more likely it is that some sort of trigger will set off a secular rise in energy prices. This can happen all at once, or slowly over time. Either way, I hope that my arguments allay any concerns about how Bitcoin would perform in a high-priced energy regime.

Curve Ball was originally published in Entrepreneur's Handbook on Medium, where people are continuing the conversation by highlighting and responding to this story.