Woomph

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The mountain go “Woomph”.

Me: Did you hear that?

In the valley of powder, certain sounds cause an immediate need to stop, listen, and adapt.

The mountain go “Woomph”.

My friend: The snow pack is failing.

Skinning on as if nothing happened could result in death. Listen to the mountain when it speaks.

The mountain go “Woomph”.

Our guide: Guess we are skiing low-angle stuff today.

My group of intrepid powder hounds stops at the mouth of a snowed-in road at the bottom of the valley. Our guide retrieves his snow saw and shovel from his pack. He then digs a 1.5m deep pit. We all huddle around the mouth of the pit to investigate the snowpack.

Our guide: See the crust there. It formed right before the last storm when it rained. Then, because of the clear nights, the snow faceted and formed a weak layer. Wow, that’s super unusual for this region.

Next, he performs an extended column test to ascertain how much energy it would take to cause the column to fail and slide. After a few taps on his shovel, the snow cracks right above the crust, and he easily slides out a block of snow 80cm tall. We all gasp because we know one skier could cause a whole face to slide on a 35-to-40-degree slope. And that’s that. We won’t be skiing anything steep, and if as we zigzag up the mountain trigger failure in the snowpack, we will exit stage left because of safety concerns.

The mountain woomph sounded the alarm to danger underneath a beautiful layer of powder. The financial markets went woomph as the yen weakened and JGB prices collapsed.[1] Quite a coincidence that both occurred in Japan. Many macro commentators smarter than I proclaimed Japan will be the match that lights the filthy fiat system ablaze. I don’t believe our betters who inhabit the relevant organs of power around the globe will allow said collapse to occur without trying to print their way out of it. Therefore, analyzing the fragility that the yen and JGB injects into global markets at this juncture is extremely important. Will a meltdown of the yen and JGB markets cause some sort of money printing by the BOJ or the Fed?[2] The answer is yes, and this essay will explain the mechanics of the said intervention that was foreshadowed last Friday.

This discussion of Japanese financial markets is important because for Bitcoin to exit its sideways funk it needs a healthy dose of money printing. What I will present is a theory which the actual flow of money through the corroded veins of the global monetary system doesn’t support yet. As time progresses, I will monitor the changes in certain line items on the Fed’s balance sheet in order to validate my hypothesis. But most importantly, I will listen for the “Woomph”. Our masters want us to trade based on their manipulations. Therefore, I must be vigilant and listen to what is said and not said by the likes of US Treasury Secretary Buffalo Bill Bessent and BOJ Governor Ueda-domo.

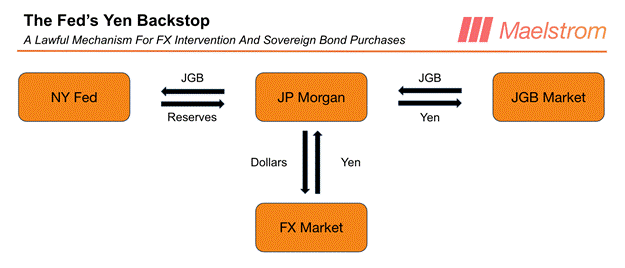

Before I provide the context that will trigger pressure on the Brrrr button, let me present this graphic to describe how the Fed will print money to expand its balance sheet and intervene in the dollar-yen currency and JGB markets.

Here are step-by-step instructions on how to manipulate the foreign currency and bond markets:

The New York Fed creates a bank reserves liability, which are dollars, with a primary dealer bank like JP Morgan.

JP Morgan sells dollars and receives yen in the FX market on behalf of the NY Fed. The yen appreciates against the dollar.

The New York Fed may invest its yen into suitable securities, of which JGBs qualify. The NY Fed instructs JP Morgan to purchase JGBs with its yen for its SOMA.[3] JGB yields fall.

The Fed’s balance sheet line item “Foreign Currency Denominated Assets” grows because of the purchased JGBs, and the bank reserves liability line item increases in the same size. The NY Fed printed dollars to buy JGBs, which reduced bond yields in Japan. As a result, the NY Fed onboards dollar-yen currency risk and JGB interest rate risk to its balance sheet. If the yen weakens or JGB yields rise / prices fall, it causes an unrealized loss to the Fed.

Why is the Fed engaging in this manipulation? What forced them to accept this currency and interest rate risk?

Japan go Woomph!

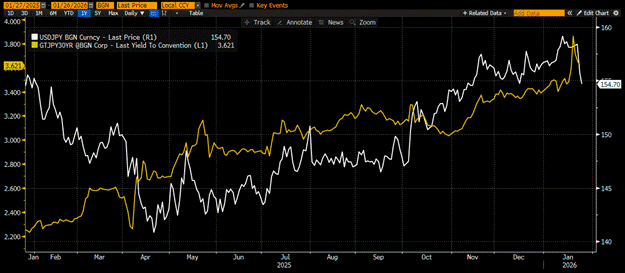

Japanese authorities lost control of the long-end of their government bond yield curve. Specifically, the yen weakened against the dollar at the same time bond yields rose. This shouldn’t happen if investors have confidence in the government’s ability to maintain the purchasing power of their filthy fiat currency and stop deficit spending. A weak yen imports inflation as Japan is a net energy importer. High JGB yields make government borrowing unaffordable. And finally, falling bond prices rack up massive unrealized losses for the BOJ, as it is the market’s largest JGB holder.

USDJPY (white), JGB 30-yr Bond yield (gold)

Why is it in US President Trump and Buffalo Bill Bessent’s interest to help? Pax Americana finances itself in the treasury market. Collectively, Japanese private investors are one of the largest holders of these bonds. Japan’s foreign debt portfolio assets total $2.4 trillion, with a majority invested in treasuries. If Japan Inc. can earn sufficient income by purchasing JGBs, then it will sell treasuries and repatriate the funds to Japan. A large, motivated marginal seller of this size would cause treasury prices to fall / yields to rise. As the US government runs the largest peacetime deficits in the country’s history, the interest costs to finance the deficit would grow faster than the number of tinder matches for recently released Caroline Ellison. Besides ballooning interest costs, if the yen weakens against the dollar, it hurts the global export competitiveness of US manufacturers.

The Fed delivered 1.75% of cuts since it began easing in September 2024 (white line). Unfortunately for Buffalo Bill Bessent, the 10-yr treasury yield (yellow line) rose slightly instead of dropping faster than ICE protestors in Minnesota. Part of this is because of sticky inflation and partly due to supply issues. As 10-year and beyond JGB yields rise (green line), Japan Inc. invests more at home rather than abroad.

How Now Brown Cow

I presented a beautiful box and arrow chart on how the Fed could intervene. But what legal pretense permits the Fed to manipulate the yen and JGB markets? Readers, contain your eye roll. I know Trump doesn’t care much for legal inconveniences, and neither did any US President before him. But sometimes those pesky checks and balances present challenges to implementing presidential prerogative, so let’s evaluate if there are legal frameworks or accepted practices that permit this behavior. Buffalo Bill Bessent can intervene in the currency markets to maintain the value of the dollar as he deems appropriate using the Exchange Stabilization Fund. The Treasury taps the NY Fed to help manipulate the markets because of its supervisory role over major New York-headquartered financial institutions. The NY Fed’s participation in this caper is required because the Treasury Department cannot print money while the creature from Jekyll Island can.

The next question is what assets can the NY Fed purchase with its yen? The NY Fed allows itself to purchase government debt securities. There is no credit risk in owning the obligation of a government in the currency it can print at will. That is the rationale that underpins the assertion that JGB holdings are high quality.

The Fed and Treasury have legal cover. The next thing we must look for evidence that confirms the existence of this yen and JGB Fed / Treasury manipulation.

The first sign post that corroborates my theory was the announcement this last Friday that the NY Fed checked prices with several Wall St dealing deals. The Fed deliberately and publicly telegraphed its intentions so that the market would front-run a potential future intervention.

On Friday, 23 January 2026 the BOJ held rates constant when by all measures they should have raised rates to defend the currency and the bond market. I’m assuming Ueda-domo called his gaijin daddy across the Pacific for some help, which kicked off the Fed-Treasury intervention talk.

The next signpost in the journey is the changes to the Fed’s balance sheet viewed through its weekly H.4.1 report. The line item to monitor is Foreign Currency Denominated Assets. They will not provide a detailed breakdown of exactly which assets it owns. We must infer from JGB price action whether the Fed is present. Even if they obfuscate what they hold officially, I bet that the Fed whisperer reporter Nick Timaros from the Wall Street Journal will receive a “leak” from a Fed insider that the institution is actively buying JGBs. The Fed will confirm these purchases because it wants us traders to invest alongside. The more investors buy, the less the Fed has to, and because these schemes create significant FX and interest rate risk for the Fed, less is more.

We know the legal fiction that permits manipulation and where to observe the evidence of its existence. What effects will this policy have upon various important financial asset prices and foreign currencies?

Beautifully Effective

This yen and JGB market manipulation by the Fed solves many financial problems for the Trump administration.

Strengthen the Yen

This will strengthen the yen against the dollar, which will help US export competitiveness.

Lower JGB Yields

Lower JGB yields will dissuade Japan Inc. from selling treasuries to buy JGBs. Japanese Prime Minister Takaichi can roll out a massive stimulus program funded by increased bond sales to placate Japanese plebes. Understandably, the average voter doesn’t relish the fact that their nation got nuked and then turned into an American colony. Prime Minister Takaichi can also increase defense spending and purchase more American-made weapons of mass destruction.

Increase Dollar Liquidity

The Fed can expand its balance sheet by printing money and with a straight face claim it’s not QE.[4] Asset prices will rise and keep the wealthy American political donors happy.

Strengthen the Euro

If you couldn’t tell, Trump and his lieutenants have no love for the Europooreans. To fully cuck Europe requires a strong euro. The dollar will mechanically weaken against most currencies, especially the euro, as the Fed prints billions of dollars to fund the purchase of yen and JGBs. A stronger euro castrates German and French exports, handing more global business to American firms.

Strengthen the Yuan

The yuan will strengthen against the dollar for the same reasons as the euro. If the yuan appreciates too quickly for Chinese President Xi Jinping’s liking, the PBOC will expand domestic credit to arrest the yuan’s rise.[5] An increase of yuan credit helps global asset prices. Some of this credit will leak into US stonks as the Chinese state and private sector are among the largest holders of US equities.

This Fed intervention is just what the filthy fiat system needs to limp along a little longer. The only problem is that the pace of yen strengthening must be gradual. It cannot appreciate too quickly, otherwise it would cause catastrophic losses for investors who borrowed yen to fund other asset purchases as volatility rose. If the Fed can smush yen volatility, a gradually strengthening yen will not cause a financial crisis.

Who gives a flying fuck that our monetary masters benefit from the Fed yen / JGB intervention. What’s in it for Satoshi’s faithful hodlers of Bitcoin and crypto?

Bitcoin (white) will pump alongside a growing Fed balance sheet (gold). It might not happen on your timeframe if you are 100x leveraged trading 1m candles on some shitcoin perp, but Bitcoin and quality shitcoins will mechanically levitate in fiat terms as the quantity of paper money rises.

Trading Tactics

A rapidly strengthening yen usually portends risk-off as yen-funded traders reduce their positions.

Bitcoin fell as the yen strengthened against the dollar. I will not increase risk before I confirm the Fed is printing money to intervene in the yen and JGB markets. If the Foreign Currency Denominated Assets line item on the Fed’s balance sheet rises w-o-w then it’s time to increase my holdings of Bitcoin. I stopped myself out of my long Strategy (MSTR US) and Metaplanet (3350 JP) trades before the yen moves thankfully. I will re-enter these levered Bitcoin proxies if my hypothesis is correct.

While I wait, Maelstrom continues to add to its Zcash ($ZEC) position. Our other quality DeFi shitcoin positions remain unchanged. And again, if the Fed is growing its balance sheet to manipulate the yen and JGB markets, we will add to our DeFi bags ($ENA, $ETHFI, $PENDLE, and $LDO).

Over and out degens, it is yet another powder day, and it’s time to shred till my legs fall off.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] JGB - Japanese Government Bond

[2] BOJ - Bank of Japan, Fed - US Federal Reserve

[3] SOMA - System Open Market Account. This is where the Fed holds financial assets it owns.

[4] QE - Quantitative Easing

[5] PBOC - People’s Bank of China

Very well explained, and a clever way to ease. We always think of QE as Fed monetization buying US treasuries. You make me think of other permutations; granted the foreign currency/bond environment has to be in the right conditions and Japan being such a large foreign investment source underscores the potential magnitude.

Great read. Thanks!