Frowny Cloud

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

The personifications of my gods take the form of cuddly plush toys. During the Hokkaido peak ski season of January and February, I pray to Frowny Cloud, the goddess of snow. The weather patterns that dominate the region ensure that in a good season, when snow is dumping almost non-stop, you never see the sun. Thankfully, I also pray to the god of vitamins, a cuddly horse ;), who, among other things, provides vitamin D3 tablets.

While I love snow, not all snow is good and safe snow. The type of carefree, hard-charging, shredding that I enjoy requires a particular type of snow. Overnight periods of low wind, with temperatures between -5 and -10 Celsius, are the prerequisites. The new snow can then bond effectively to the old and create the conditions for bottomless powder. During the day, Frowny Cloud obstructs certain wavelengths of sunlight, preventing certain aspects, like south-facing pitches, from getting cooked and possibly sliding.

Sometimes Frowny Cloud deserts us intrepid skiers at night. And a cold, clear night creates facets after a warming and then cooling of the snowpack, which produces a persistent weak layer. This phenomenon persists in the snowpack for some time, and can cause deadly avalanches when it collapses because of the energy transfer from the weight of skiers.

As always, the only way to know what type of snow pack Frowny Cloud created is to study history. On the slopes, we do this by digging massive pits and analyzing the different types of snow that fell over time. But as this is not an essay on avalanche theory, the way we do this in markets is by studying charts and the interplay between historical events and price movements.

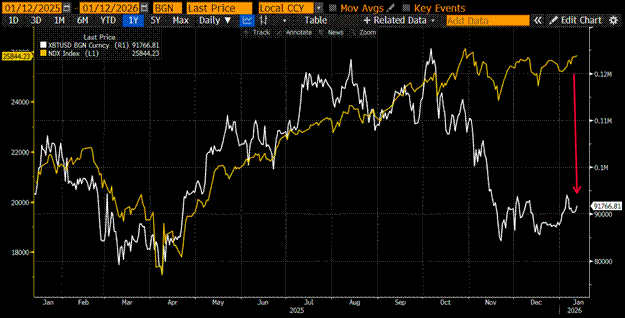

The relationship I wish to study throughout this essay is between Bitcoin, gold, stonks (specifically big US technology stocks that comprise the Nasdaq 100), and dollar liquidity. The crypto naysayers who are gold bugs or Hermes noose, red bottom wearing members of the financial establishment that believe in “Stocks for the long run” (I didn’t have a high enough GPA to get into Seigel’s class at Wharton), are ecstatic that Bitcoin was the worst performing major asset class of 2025. These gold bugs tut-tut at the crypto fam because if Bitcoin was supposed to be this vote against the established order, then why then did it not match or exceed the performance of gold? The filthy fiat stonk pushers tut-tut at the crypto fam that Bitcoin is just a high beta play on the Nasdaq except it wasn’t in 2025; why then is crypto worth considering at all in any portfolio?

This essay will present a cornucopia of chart porn annotated with my thoughts to contextualize the co-movement of these assets. I believe Bitcoin did exactly what it was supposed to do. It rode the wave of fiat liquidity lower, specifically dollar liquidity, as Pax Americana’s credit impulse was the most important force in 2025. Gold surged as price-insensitive sovereign nations hoovered it up because they were afraid to remain in US treasuries lest Pax Americana steal their wealth like it did to Russia in 2022. The act of war committed upon Venezuela by Pax Americana most recently only intensifies the desire for nations to save in gold rather than US treasuries. Finally, the AI bubble and all the ancillary industries that benefit, are not going anywhere. In fact, US President Trump must double down on state support for all things AI because it is the largest contributor to GDP growth in the empire. This means that even if the pace of dollar creation slows, the Nasdaq can continue to rise because Trump effectively nationalized it. For those of you who study Chinese capital markets, you know stonks do very well in the early period of nationalization, but then underperform massively as political goals take precedence over return on equity for unpatriotic capitalists.

If the 2025 price action of Bitcoin, gold, and stonks validated my market schema, then I can continue focusing on the vicissitudes of dollar liquidity. To remind readers, my prognosis is that Trump will pump credit to run the economy fucking hot. A rip-roaring economy helps the re-election chances for Team Red Republicans this November. Dollar credit will expand as the central bank balance sheet grows, commercial banks lend more to “strategic industries”, and mortgage rates decline because of printed money.

When we put all of this historical analysis together, does it mean I can continue to shred carefree, by that I mean aggressively deploy new units of fiat I earn, and maintain my maximal risk exposure? You be the judge.

One Chart that Rules Them All

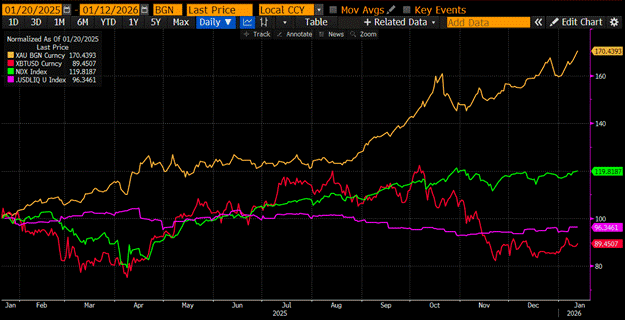

To set the stage, let’s compare the returns of Bitcoin, gold, and the Nasdaq in the first year of Trump’s second reign. How did these assets perform against the change in dollar liquidity?

I will go into more detail later in the essay, but the assumption is that if dollar liquidity falls, these assets should as well. However, gold and stonks rose. Bitcoin performed as to be expected, like utter dog shit. Next, I will explain why gold and stonks outperformed given that dollar liquidity fell.

Bitcoin (red), Gold (gold), Nasdaq 100 (green), and Dollar Liquidity (magenta)

All That Glitters

I started my journey into crypto through gold. As Fed-sponsored QE ramped up in 2010 and 2011, I began buying physical gold coins in Hong Kong.[1] My size in absolute terms was pitiful, but as a percentage of my then net worth, enormous. Ultimately, I learned a hard lesson about position sizing as I had to sell my gold coins at a loss to buy Bitcoin to conduct cash and carry trades on ICBIT starting in 2013. It all worked out in the end, thankfully. After all of that, I still hold a significant amount of physical gold coins and bars in vaults around the world, and gold and silver mining equities dominate my stonk portfolio. Readers may wonder why I still own gold given I am a loyal disciple of Lord Satoshi?

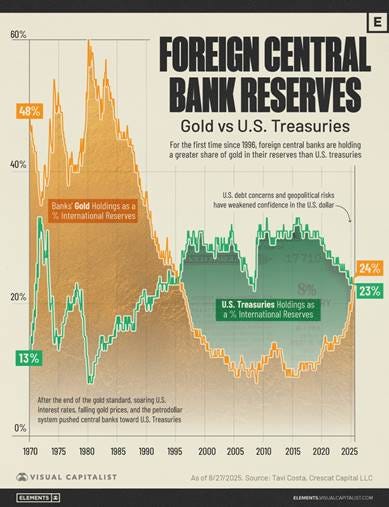

I own gold because we are in the beginning stages of a global trend where central banks sell US treasuries and purchase gold. In addition, counties now settle trade imbalances in gold. This is even true when we analyze Pax Americana’s trade deficit.

In short, I buy gold because central banks buy gold. Gold has a 10,000-year history as the true money of civilization. As such, no major central bank reserves manager will save in Bitcoin if they distrust the current dollar-led filthy fiat financial system. They will and are buying gold. If gold’s percentage of total central bank reserves reverts to where it was in the 1980s, the price would rise to ~$12,000. Before you believe my pie in the sky prediction, let me prove it to you visually.

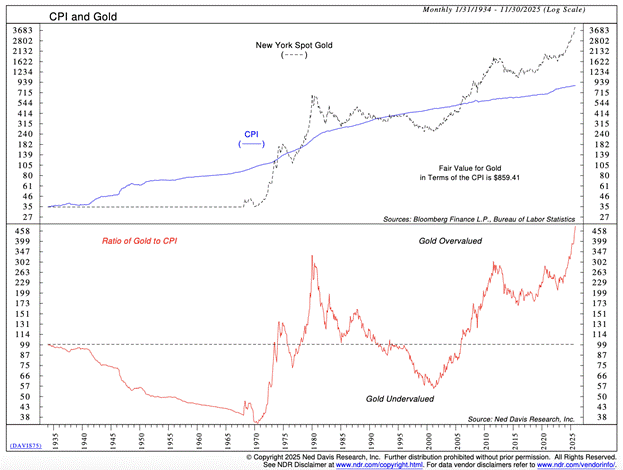

The orthodox view of gold within a fiat system is that it is an inflation hedge. Therefore, it should roughly track the empire’s manipulated CPI inflation index. The chart above shows that since the 1930s, gold has roughly tracked the index. However, since 2008 and then accelerating after 2022, gold’s price rapidly ascended faster than inflation. Is gold in a bubble poised to decimate punters like me?

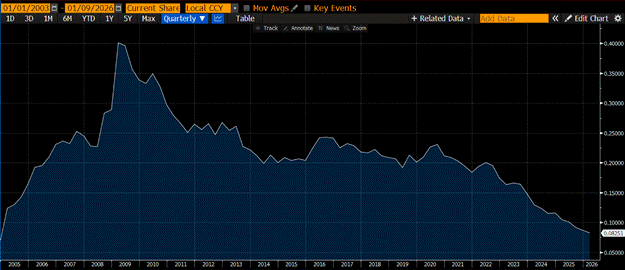

If gold is in a bubble, retail would pile in. The most popular way to trade gold is via ETFs, of which GLD US is the largest.[2] When retail YOLO’s into gold, the GLD shares outstanding increase. In order to compare this phenomenon across time and different gold price regimes, we must divide GLD’s shares outstanding by the price of physical gold. The chart below shows that the ratio is falling, not rising, which means a genuine gold speculative mania has not taken hold yet.

GLD US shares outstanding divided by the spot price of gold

If retail schmucks aren’t pamping gold, who is the price-insensitive buyer? Central bankers all across the globe. There were two seminal moments within the last two decades that convinced the high monetary priests that Pax Americana’s currency is only fit to wipe one’s ass with.

In 2008, Pax Americana’s financial masters of the universe created a global deflationary financial panic. Unlike the 1929 episode, where credit destruction occurred relatively unmolested by the Fed. This time around, the Fed defaulted on its obligation to maintain the dollar’s purchasing power and printed money to “save” certain large financial players. This marked the apex and nadir of sovereign nations’ holdings of US treasuries and gold, respectively.

In 2022, US President Biden stunned the world when he froze the treasury holdings of a nation that holds the largest stockpile of nuclear weapons and is the world’s biggest commodity exporter. That nation is Russia. If the US is willing to abrogate the property rights of Russia, then they could do it to any less powerful or naturally rich nation. Predictably, other nations could not in good faith increase their exposure to expropriation by holding treasuries. They began accelerating their purchases of gold. The central banks are price-insensitive buyers of gold. If the US president steals your money, it’s an instant zero. Does it then matter what price you buy gold at if it removes your counterparty risk?

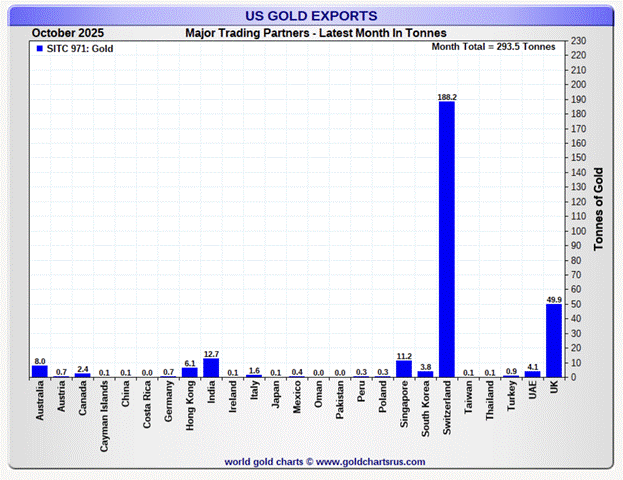

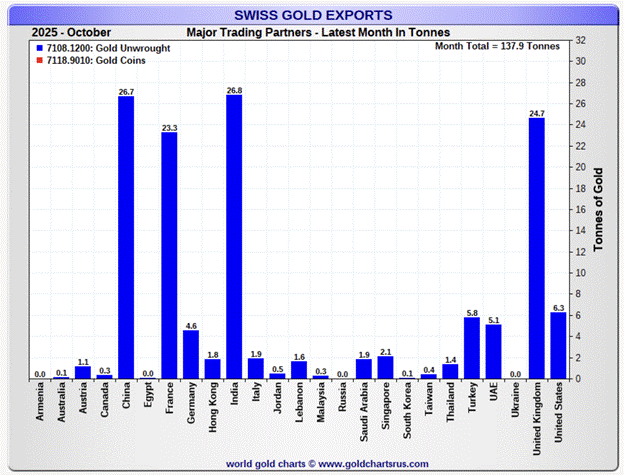

The ultimate reason there is an insatiable appetite from sovereigns for the barbaric relic is that settlement of net trade imbalances happens increasingly in gold. The record contraction of the US trade deficit in December 2025 is proof that gold is reestablishing itself as the true global reserve currency. Greater than 100% of the change in the net trade balance of America is because of exports of gold.

The gap between exports and imports of goods fell by 11 per cent from the previous month to $52.8bn, according to data released by the US Department of Commerce on Thursday. That shrank the deficit to its smallest since June 2020 and was also narrower than the $63.3bn gap that economists polled by Reuters had predicted. The 3 per cent increase in exports from August to $289.3bn was mostly fueled by non-monetary gold. Imports climbed 0.6 per cent.

– Source: FT

The gold flow: America exports gold to Switzerland, which refines and recasts it into different denominations, and then shipped to other nations. The charts below show that mostly China, India and other emerging economies that make real stuff or export commodities purchased the gold. That stuff ultimately ends up in America, and gold flows out to the more productive parts of the world. By productive I don’t mean that these places are better at filling out bullshit TPS reports and their email signatures feature the appropriate pronouns, but that they export energy and other crucial industrial commodities, and their plebes create real stuff like steel and refined rare earths. Gold rose when dollar liquidity fell because sovereign nations are increasing the pace of the reinstatement of the global gold standard.

Long Duration Loves Liquidity

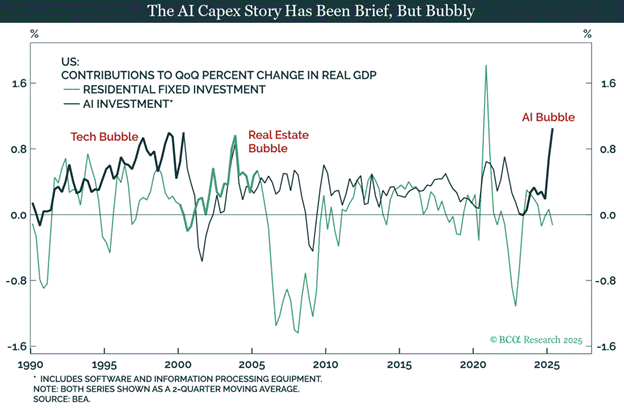

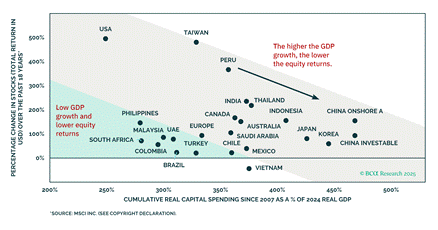

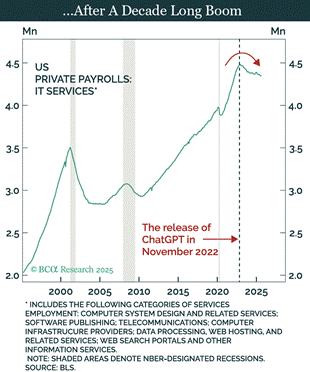

In every era there are high-flying technology stonks. During the roaring 1920s US bull market, RCA - the radio manufacturer - was the hot tech stock of the day. In the 1960s and 1970s, it was IBM that made the newfangled mainframe computers. Today, AI hyper-scalers and chip makers are en fuego.

Humans are natural optimists. We love to forecast a glorious future where the money spent today by tech companies results in a societal utopia. For those fortunate enough to own the future through equity in said businesses, riches will rain down from the heavens. To eventuate this certain future in the minds of investors, companies burn cash and take on debt. When liquidity is cheap, it becomes easy to bet on the future because in the future copious cash flows will accrue to these intrepid entrepreneurs. As such, investors are happy to splooge worthless cash today on tech stonks for a chance to own much larger future cash flows, which pumps up their price to earnings multiples. Therefore, technology growth stocks rise exponentially during periods of excess liquidity.

Bitcoin is monetary technology. The technology is valuable only in relation to the amount of fiat debasement. The invention of the proof-of-work blockchain, which achieves a form of Byzantine fault tolerance, is stupendous. This alone guarantees that Bitcoin’s value is greater than zero. But for Bitcoin to be worth close to 100,000 United States of American Dollars requires continuous fiat monetary debasement. Bitcoin’s asymptotic rise directly results from an explosion in the supply of dollars post the 2008 Global Financial Crisis.

Therefore, I say:

Bitcoin and the Nasdaq rise when dollar liquidity expands.

The only problem with that statement is the recent divergence of the Bitcoin price from the Nasdaq.

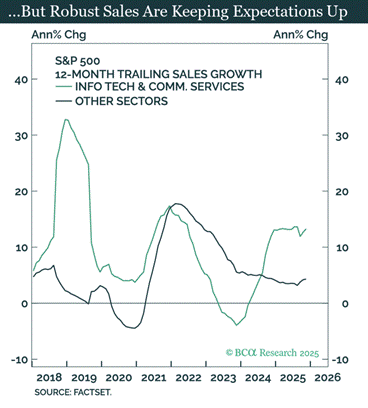

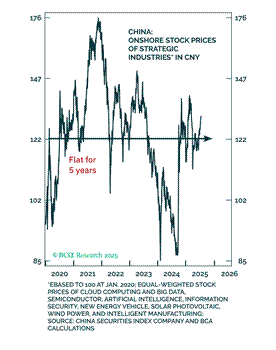

My theory of why the Nasdaq has not corrected in line with the decline in dollar liquidity in 2025 is that AI became nationalized by both China and America.

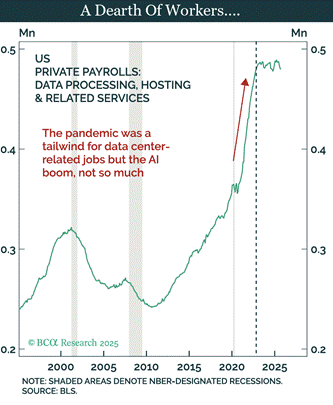

The AI tech bros sold the two leaders of the world’s largest nation states the idea that AI solves everything. AI reduces the cost of labor to zero, cures cancer, increases productivity, democratizes creativity, and, most importantly, allows for military domination of the planet. Therefore, whichever nation “wins” at AI, and there is no clear definition of winning, rules the world. China bought into this techno future long ago, and it fits squarely into how the Politburo sets top-down goals in successive five-year plans. Chinese equity investors routinely scour each five-year plan and its yearly revisions to discern which industries and their respective stonks the government will favor with cheap credit and the permission to compete in a ruthless capitalistic fashion. In America, such analysis is a new thing, at least in this epoch. Industrial policy is just as American as it is Chinese, although the marketing is different. Trump drank the AI Kool-Aid, and now “winning” AI is part of his economic platform. The US government de facto nationalized any components that are assumed to go hand in hand with “winning”. Through executive orders and government investment, Trump is blunting the free market signals so that capital, irrespective of the real return on equity, floods into everything related to AI. That is why the Nasdaq decoupled from Bitcoin and the decline of dollar liquidity in 2025.

Bubble or not, growth in spending to “win” AI drives the US economy. Trump campaigned on running the economy hot, so he can’t stop now just because when we look back in a few years hence the return on equity for all this spending fell short of the cost of capital.

US tech investors should be careful what they wish for. US industrial policy aimed at “winning” AI is a surefire way to scorch one’s capital. Trump’s, or whoever comes next, political goals will diverge from what is in the best interest of shareholders of firms that are deemed strategic. This is a lesson Chinese stonk investors learned the hard way. Confucius says, “Learn from thy ancestors”. That lesson is obviously not being internalized given the Nasdaq’s outperformance.

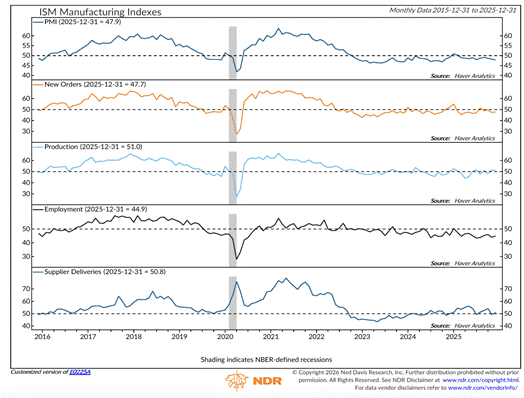

A reading below 50 indicates contraction. All that GDP growth is not creating a resurgence in manufacturing.

I thought Trump was for the working white man? Nah, Jimbo, US President Clinton sold your job to China, then Trump got the factories to come back, but the floor is now populated by AI-enabled robot arms owned by Elon. Sorry, you got cucked again, but ICE is hiring![3]

These charts clearly show that Nasdaq Number Go Up is US state-sponsored. As such, as an industry, even if overall dollar credit growth is anemic or contracting, AI will receive all the capital it needs to “win”. Therefore, the Nasdaq decoupled from my dollar liquidity index and outperformed Bitcoin in 2025. I do not believe the AI bubble is ready to pop. This outperformance will be a feature of global capital markets until it ain’t, or most likely until the Team Blue Democrats take over the House of Representatives in 2026, as Polymarket predicts, and possibly the presidency in 2028. If the Republicans are the party of the Jetsons, the Democrats are the party of the Flintstones.

If gold and the Nasdaq have the juice, how is Bitcoin going to get its groove back? Dollar liquidity must expand for that to happen. Obviously, I believe it will in 2026, so let’s discuss how.

Run it Fucking Hot

At the outset, I said there are three pillars supporting a drastic increase in dollar liquidity this year:

The Fed balance sheet will grow because of money printing.

Commercial banks will lend to strategic industries.

Mortgage rates will drop because of money printing.

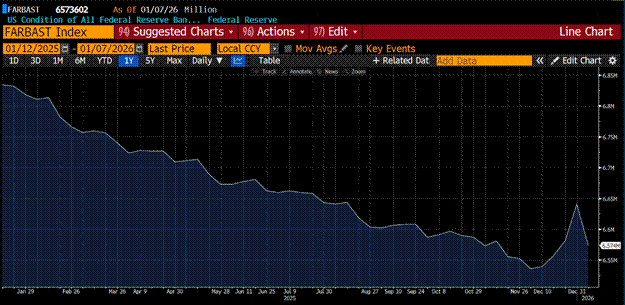

The Fed’s balance sheet, pictured above, fell throughout 2025 because of QT.[4] QT ended in December, and at that month’s meeting the Fed launched its newest money-printing caper called Reserve Management Purchases (RMP). I discussed the mechanics of RMP in depth in my essay “Love Language”. The chart clearly shows that the balance sheet bottomed in December. RMP at a minimum, pumps the balance sheet by $40 billion per month. RMP purchases will increase as more money is required to fund the US government.

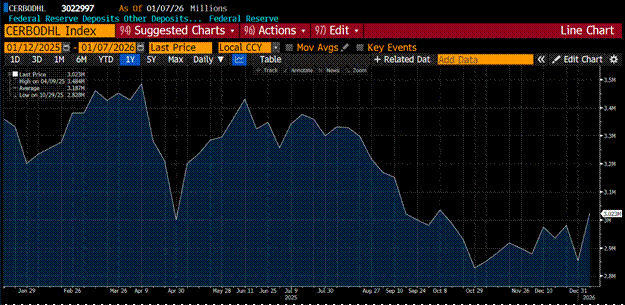

The above chart is a weekly measure published by the Fed of the US banking system’s loan growth called Other Deposits and Liabilities (ODL). Reading Lacy Hunt put me onto this one. Starting in 4Q25, banks issued more loans. When a bank issues a loan, it creates a deposit, which creates money ex nihilo. Banks like JP Morgan are happy to lend to businesses directly supported by the US government. JP Morgan launched a $1.5 trillion loan facility for that purpose. It goes like this. The US government invests equity into a business or provides an offtake agreement, then that business will apply for a loan from JP Morgan or another large commercial bank to expand production. The government backstop reduces the risk of default by guaranteeing demand, and therefore the bank is happy to create money to finance the strategic industry. This is exactly what China does. Credit creation moves away from the central bank and into the commercial banking system where, at least in the beginning, the velocity of money is much higher. This creates above-trend nominal GDP growth.

The US will continue to flex its military muscle, and to do so requires the production of weapons of mass destruction financed by the commercial banking system. That is why bank credit growth will enjoy a secular rise throughout 2026.

Trump is a real estate man. He knows how to find financing for the construction of property. The newest proclamation from Augustus Trump is that the Government Sponsored Entities named Fannie Mae and Freddie Mac shall use capital on their balance sheet to purchase $200 billion worth of MBS.[5] This is an increase in dollar liquidity as before Trump’s order, this capital sat inert on Fannie and Freddie’s balance sheets. If he is successful, Trump won’t stop there. Pumping the housing market through lower mortgage rates will allow many Americans to borrow against the record high equity value of their homes. This increase in wealth effect will make the 99% feel good on election day and vote Team Red Republican. And most importantly for us risk asset holders, create more credit with which to buy financial baubles.

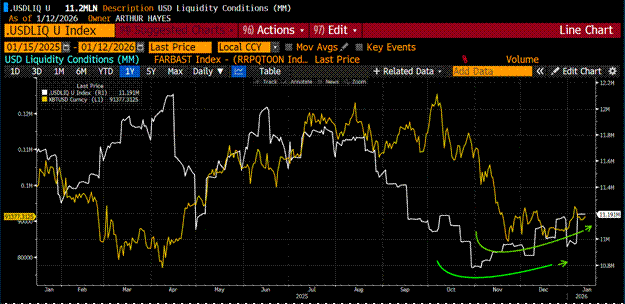

Bitcoin (gold) and dollar liquidity (white) bottomed around the same time. As dollar liquidity rapidly increases for the reasons described above, Bitcoin will follow. Forget about 2025 and Bitcoin’s underperformance; the liquidity didn’t support our crypto portfolios. But let’s not draw the wrong conclusions from Bitcoin’s 2025 underperformance. It was as it always is, a liquidity story.

Trading Tactics

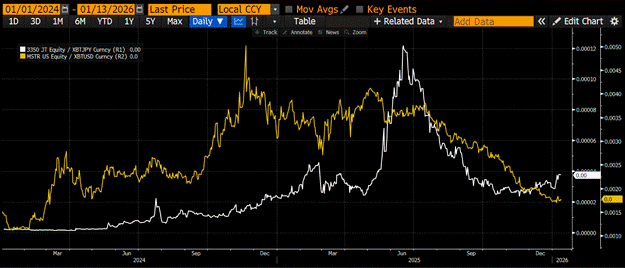

I’m a degen speculator. Even though Maelstrom is nearly fully invested, I want to add on MOAR risk because I am so bullish on the growth of dollar liquidity. Therefore, I put on long Strategy (MSTR US) and Metaplanet (3350 JT) positions to get levered exposure to Bitcoin without trading a perp or options derivative.

I divided each DAT by the price of Bitcoin in yen for Metaplanet (white) and dollars for Strategy (gold). They are at the low end of the range over the past two years, and from their peaks in mid-2025 are down substantially. If Bitcoin can retake $110,000, investors will get the itch to go long Bitcoin through these vehicles. Given the leverage embedded in the capital structure of these businesses, they will outperform Bitcoin on the upside.

In other news, we continue to add to our Zcash position. The departure of the devs at ECC is not bearish. I firmly believe they will ship better, more impactful products within their own for-profit entity. I’m thankful for the opportunity to buy discounted ZEC from weak hands.

Onward and upward, degens. Be safe out there; it’s a dangerous world. Peace be with you, and all hail Frowny Cloud.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] QE - Quantitative Easing. This is the process by which a central bank prints money to buy financial assets and in the process its balance sheet grows.

[2] ETF - Exchange Traded Fund

[3] ICE - Immigration and Customs Enforcement

[4] QT - Quantitative Tightening. This is where a central bank sells assets on its balance sheet thus destroying money which leads to a contraction in fiat liquidity.

[5] MBS - Mortgage-Backed Security

Another great read, thanks for the content and insights

Competition for a plush lifestyle runs hot. The choice remains where tolerance rests. Shred first ☁️ throw dice after 👑