This Is Fine

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

When the fire alarm rings in your apartment or office building, you usually dismiss it. But sometimes death comes swiftly to those who ignore obvious warnings. Given the amount of noise swirling throughout our daily lives, understanding what alarms to heed could save your life or your portfolio.

Bitcoin is the global fiat liquidity fire alarm. It is the most responsive freely traded asset to the fiat credit supply. The divergence recently between Bitcoin and the Nasdaq 100 Index (“Nasdaq”) sounds the alarm that a massive credit destruction event is nigh. Many investors perceive Bitcoin, because of its past correlation with US big tech stonks, as a leveraged play on the Nasdaq. Therefore, when they diverge in performance, it warrants further investigation into any trigger that could cause a destruction of fiat, but mostly dollar, credit, aka DEFLATION!

Deflation is bad, but ultimately good for fiat credit-sensitive assets like Bitcoin. First, the market prices the impact of severe impairment on debt assets on financial institutions’ balance sheets. Then a few of the worst-managed or highest levered financial institutions become insolvent based on their stock price. Finally, the monetary mandarins panic and press that Brrrr button harder than I shred pow the morning after a one-meter dump. The surge in fiat credit creation pumps Bitcoin decisively off its lows, and the future expectation of increased fiat creation to save the banking system propels Bitcoin to a new all-time high.

This process can take years or months. The most severe credit deflationary event of this century was the 2008 GFC.[1] At a high level, the market priced in delinquencies on subprime mortgages offered to the increasing number of poor American folks who lost and would lose their jobs because of the rising Chinese manufacturing juggernaut. China formally entered the WTO in 2001.[2] It took seven years for this policy to bankrupt the over leveraged US banking system mainly because the decision to offshore a manufacturing facility and rejig one’s supply chain takes time.

This time around the market will discount the impact on consumer credit and mortgage debt because of the inability of white-collar knowledge worker debt donkeys to meet their monthly payments. These deadbeats lack the ability to pay because AI took der jobs!

That’s a bold statement to call for a financial crisis because of job losses caused by AI adoption. The official narrative is that creative destruction will lead to higher productivity, people will retrain to do who knows what, and utopia will reign in Pax Americana. This is the economic dogma guiding the Trump administration. They believe AI will drive productivity growth so high that they can simultaneously lower interest rates and reduce the debt load paid for by taxes from corporate profits due to 15% real GDP growth per year. Yes, 15 fucking percent, that’s what the big man Trump proclaimed. However, before this glorious American future handed down by a Caucasian male Christian god can occur, millions of high-earning, debt-laden, white-collar plebes will lose their jobs. The banking system will buckle under the assumed losses on its holdings of consumer credit loans and mortgages.

First, I will step through my simple model that predicts in broad strokes the quantum of credit losses in store for US commercial banks. Next, I will present the early warning signs offered by Bitcoin and software SaaS stonk price action. Finally, I can speak to the political sclerosis at the Fed that will cause them to dither until shit gets really bad. The worse the fall, the harder the central wanker bankers press that Brr button. This AI financial crisis will restart the money printing machine for realz. But don’t get it twisted. There are two scenarios for Bitcoin and shitcoins. Either Bitcoin’s dump from $126,000 to $60,000 was the entire downward move and stonks will catch up, or Bitcoin will dump further as stocks meet their maker. It behooves punters to limit the use of leverage and wait for the all-clear from the Fed that it’s time to dump filthy fiat and ape into risky assets with wanton abandon.

Anatomy of Default

The model’s objective is to predict, using valid assumptions, the total approximate amount of consumer credit and mortgage defaults attributed to white-collar knowledge workers being replaced by AI tools like Claude.

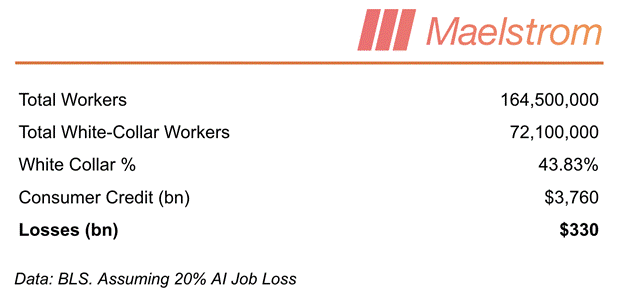

According to the US BLS, there are currently 72.1 million knowledge workers out of a total working population of 164.5 million. [3]

These knowledge workers earn more on average than other Americans and thus power the empire’s consumer-led economy. I am interested in estimating on average how much consumer credit (e.g. credit card balances, auto loans etc.) they shoulder. According to the Fed, the total amount of consumer credit is $5.1 trillion. Because I’m only interested in loans the banking system holds as assets on its balance sheet, I must strip out student loans, which are usually underwritten by the government. Doing this brings the total down to $3.76 trillion.

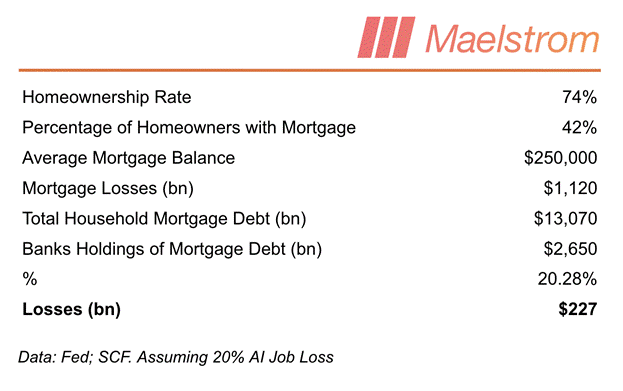

These high flyers also borrow money to purchase their dwelling. The average annual income of a knowledge worker is $85,000, which places them around the 70th percentile of income earners. Folks in this decile have a homeownership rate of 74% and on average 42% of homeowners have a mortgage. Knowledge workers carry an approximate average mortgage balance of $250,000.[4]

With these inputs, the next step is to calculate the losses to banks if 20% of knowledge workers vanished because of AI. I know that CEOs or lead researchers at various prominent AI companies call for an almost complete eradication of most knowledge work performed by humans within the next two years. While that may be true in the longer term, I want to know if even a modest culling of these folks would cause a financial crisis. For example, China’s entry into the WTO deaded 35% of Americans working in the manufacturing industry over the next few decades. Blue-collar workers manipulate atoms, which are harder to move from one place to another than bits. Knowledge workers manipulate bits, which can move at the speed of light. Therefore, because AI similarly manipulates digital symbols faster than a human, the pace of white vs. blue-collar job losses will be much faster. The labor market in the US is very flexible and employers can fire folks at will with little to no financial consequences, unlike more socialist countries in Europe or Asia, e.g. Japan. Therefore, a profit maximizing corporation will quickly fire a sizable chunk of its knowledge workers if the AI tools are 10 or 100 times faster than a qualified human.

The market will assume unemployed workers cannot meet their monthly payments on consumer credit and mortgages. Then the banks that survive will severely restrict the amount of consumer and mortgage lending because they do not know how the previously wealthiest workers will earn a living in the age of AI. Without the flow of credit, demand for real goods collapses. This is how a banking crisis completely grinds Pax Americana’s economy to a halt.

Consumer Credit Losses

The market will price in $330bn of losses to banks consumer credit portfolios.

Mortgage Debt Losses

The market will price in $227bn of losses to banks mortgage debt portfolios.

The Result

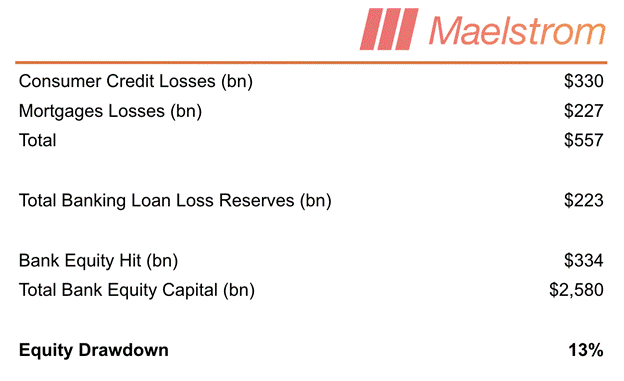

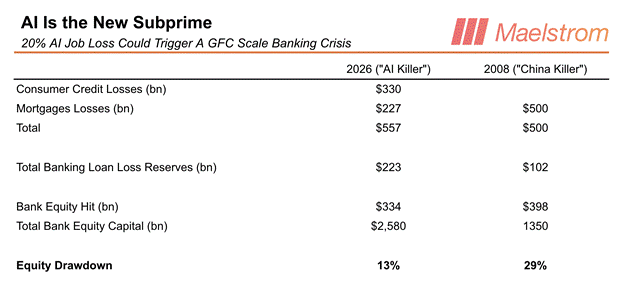

Banks reserve part of profits each quarter against losses on their loan books. The FDIC publishes the industry-wide total loan loss reserves quarterly.[5] Subtracting that from the consumer credit and mortgage debt losses tells us how large of a hit to their equity this AI deflationary event causes. When viewed against the total US commercial bank equity capitalization, this event would cause a 13% write-down.

13% might not seem like a big deal, but not all banks are created equal. There are thousands of banks, and only eight (Too Big to Fail, “TBTF”) have a government guarantee because of the post-2008 GFC banking regulations put into place. The TBTF banks will be fine as they are the best capitalized and run banks in the empire. But there will be many cockroach banks that took more risk with the types of folks they lent to or employ much higher balance sheet leverage. The market will sniff out these weak banks and destroy their stock prices. The banks will breach their regulatory capital adequacy ratios, and depositors will flee. This will be a rerun of the regional bank crisis in early 2023 that destroyed three banks in a fortnight. But this time it will be much worse, as the genesis of the crisis is the unstoppable nature of AI, a narrative the market believes and is terrified by. Sell and withdraw first; investigate later. This is how investors and depositors will approach this situation as soon as everyone knows that everyone knows that all white-collar workers will lose out to AI tools and thus cannot pay their bills.

To put this into context, here are the same numbers for the 2008 GFC.

Assuming a 20% almost immediate decline in knowledge workers is about half as deadly as the 2008 GFC. The Fed printed money for over a decade to repair the financial system in response to the 2008 GFC. I expect a similar thrust higher in Fed monetary shenanigans in 2026 once a wide swath of non-TBTF banks will go under if they don’t solve their internal political squabbles and print dat money.

AI Destruction Chart Porn

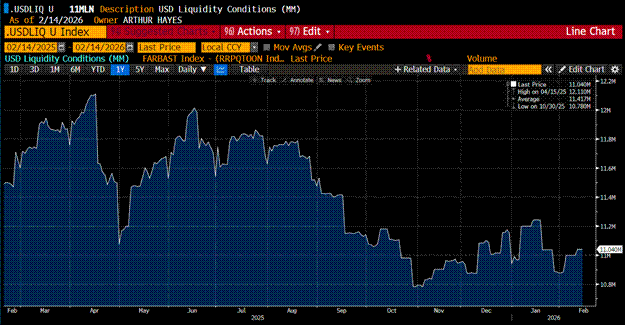

As always, my guiding light in investing is fiat credit creation. Let’s start with my USD liquidity index.

As you can see, falling liquidity forces the market on the dwindling prospects for certain tech businesses because of AI adoption.

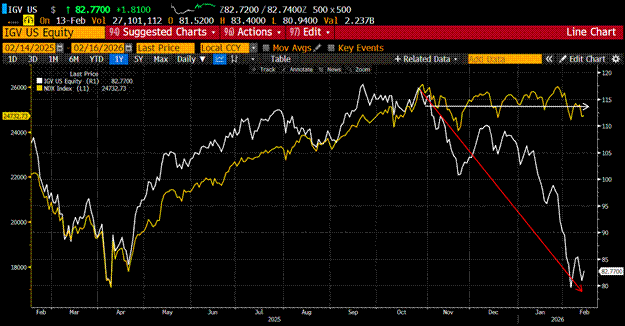

If AI tools like Anthropic’s Claude Cowork can reliably complete tasks in minutes, that would take a human hours or days, why do you need all those SaaS productivity subscriptions? The market came after the tools of knowledge workers first. That is why the iShares Software ETF IGV (white) which represents listed software SaaS businesses, tanked vs. the broader Nasdaq (gold).

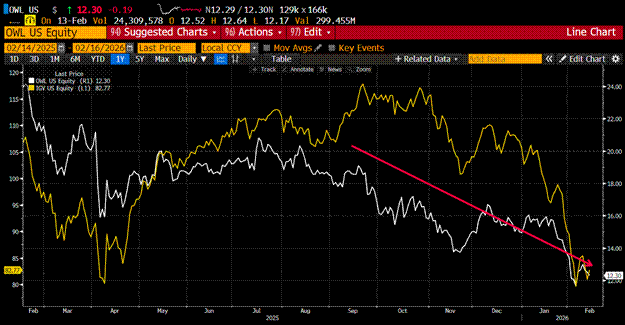

Then the market attacked those non-bank lenders who lent to these SaaS businesses. Blue Owl (white), the former market darling in the private credit space, got owned alongside IGV (gold).

Now that the market believes fewer sales of SaaS tools to knowledge workers, it is time to discount the impact to various sectors if the users of those tools find themselves irrelevant as well.

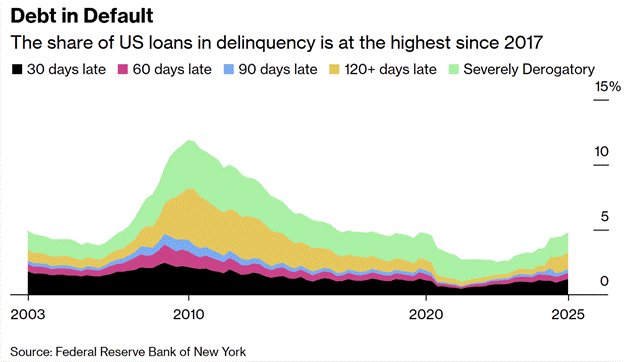

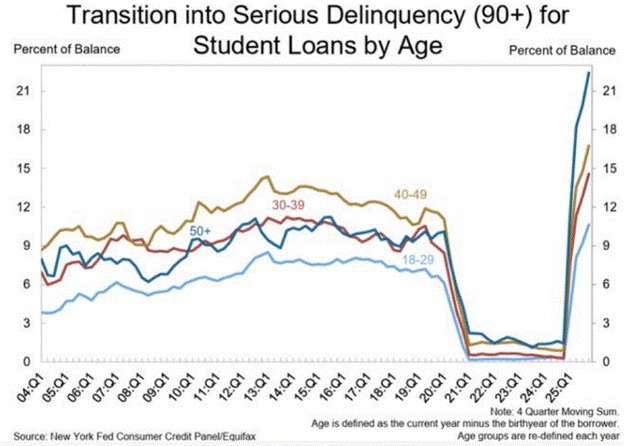

First, let’s observe what’s happening at the base of the credit pyramid; as some workers lose their jobs, delinquencies rise.

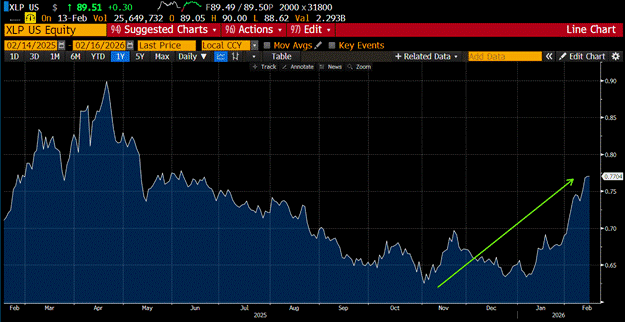

If the consumer cannot meet their monthly credit card payments, the next sector hit is consumer discretionary stocks.

The above chart is the ratio of the SPDR Consumer Staples ETF (XLP US) to the SPDR Consumer Discretionary ETF (XLY US). As you can see by the rising ratio as of late, XLP is massively outperforming XLY. This means the plebes shop more at discount retailers like Walmart than mindlessly ordering knick-knacks on Amazon or overpaying for Tesla EVs. Walmart and Amazon/Tesla are the largest weightings in XLP and XLY, respectively.

The financial institutions that cater to the soon to be broke as fuck white-collar workers like American Express (AXP US in white) held serve while the employers of their borrowers (IGV US in gold) got punished by the markets. But lenders’ outperformance will wane as the market fully prices in the future culling of knowledge workers.

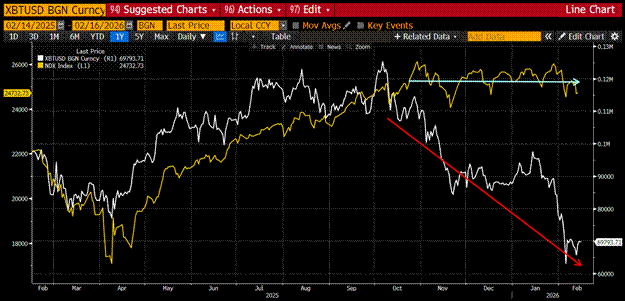

When in doubt about whether USD liquidity is ample, turn to Bitcoin.

Nasdaq (gold) is flat whilst Bitcoin (white) plunged since Bitcoin hit its all-time high in October 2025.

A surging gold (gold) versus a slumping Bitcoin (white) clearly tells us that a deflationary risk-off credit event within Pax Americana is brewing.

A Dithering Fed

If we all know empirically that eventually the Fed prints money to save the banking system from credit loss created deflation, then why isn’t Bitcoin soaring as AI-related knowledge worker job losses accelerate? Because in order to act bigly, the Fed always needs a crisis.

In the lead-up to the 2008 GFC, the mantra was that “US housing prices never fall”. If they never fall, then there is nothing to worry about if two random Bear Stern hedge funds bit the dust because of subprime mortgage losses in 2007. Similarly, today the mantra is that “AI will lead the highest productivity growth ever”. Again, why should the Fed act if some fugazi magic internet money token crashed or a few high-flying shadow banks got their comeuppance for lax underwriting standards?

To add to the inertia preventing the Fed from acting is the political crisis that engulfs it. US President Trump crossed the Rubicon and launched a criminal investigation into the Fed chairperson beta cuck towel bitch boy Powell. Like any institution made up of human cells, when you threaten the ideological glue that defines folks and their supposed broader mission, they band together. Those within the Fed truly believe they are independent and above politics, even though the historical record is very clear that the Fed always delivers the monetary policy the president desires, eventually. By criminally investigating Powell ostensibly because he refused to lower interest rates and print money fast enough, Powell’s pride might seriously compel him to remain on the Fed board of governors when his chair term is up in May. At that point, assuming Trump can get his pick for chairperson to be confirmed by the Senate, which is not a given, Kevin Warsh will preside over a hostile Fed.

Warsh is supposedly in favor of a smaller Fed balance sheet and wants to institute many other “radical” changes to how the Fed operates and regulates the banking industry. Whether these are sound policies in the minds of other governors isn’t relevant; Warsh is Trump’s chairperson. And if Powell remains and carries at least five other voting governors in his camp, he can obstruct Trump’s agenda and preserve the Fed’s political independence through inaction.

While the Fed is fighting windmills, AI-related job losses will destroy the balance sheets of American banks. And then, finally, the non-TBTF banking stocks will start crashing, depositors will flee to safety in JP Morgan CEO Jamie Dimon’s arms, and credit markets will seize up. The market will frantically ask which credit sector is next to experience the wrath of AI optimization? And because scared traders optimize for immediate liquidity, they will dump everything. The stock market collapses and Bitcoin trades sideways, or Bitcoin slices through $60,000 and continues going until the Fed gins up the money printer.

What About the Discount Window?

In theory, if a US-regulated bank or bank branch runs into trouble where it needs to sell assets quickly to meet depositor withdrawals, it can access the Fed’s discount window. The problem with the discount window is that it assumes that the problem is purely one of duration mismatch and liquidity. However, in this circumstance, the loans on the balance sheet are worth zero because of an inability to pay by the borrower.

Once AI takes your accountancy, legal, investment banking, etc. jobs, they ain’t coming back. Maybe after a few years of retraining, you can get another job in whatever newfangled employment sector emerges because of AI, but that will take many years if it happens at all. You cannot service your debts in the meantime, and the market will price that collateralized auto loan debt obligation as zero. This would violate the Fed’s underwriting standards, and to provide a blank amount of printed money to banks to coerce them to lend again to deadbeat former masters of the universe will take a complete overhaul of how the discount window operates. And unfortunately, that sort of change will require new policies that the governors must vote upon.

Print Baby Print!

Everyone knows that everyone knows that AI is the most transformative general-purpose technology in human history. The consensus also believes that once AI comes for the arrogant college educated paper pushing lawyer, Lord Elon or more likely his Chinese competitors, will launch AI-powered robots that reduce the price of labor to near zero. Faced with these “truths”, the Fed must print bigger than it’s ever printed before. And the best part is that the politicians are so afraid of AI-sponsored credit deflation, they will gladly support another round of QE infinity. [6]

There are many ways to print money; I will not speculate on how. But just like on Sunday, 12 March 2023, after Signature Bank collapsed, there will be an emergency announcement. Buffalo Bill Bessent and whoever the Fed chairperson is at the time will announce some joint program that in effect prints money.[7] And then wham bam thank you ma’am it’s time to back up the fucking truck and buy Bitcoin and shitcoins like it’s 2020.

Stay Nimble

Because AI models now build their next iteration, the pace of improvement occurs non-linearly. This means that if you operate on the assumption that AI isn’t accurate enough to do some knowledge-related tasks because you tried last year, your opinion is out of date. Shit is getting real, and millions of knowledge workers will swallow their pride and apply for a government handout like a welfare king or queen from the hood.

I don’t believe Bitcoin traders will see through to the eventual Fed banking bailout until consumer credit-sensitive stocks experience serious pain. I won’t short the market, but long selling to raise cash if one hasn’t done so might be prudent. If an asset’s price drops from 10 to 5, a short makes 50%, but when the price rebounds from 5 to 10, a long doubles their money. Therefore, the game is to be liquid, nimble, and play for the rebound. Shorting is a mug’s game. Always Be Longing Convexity!

The top two shitcoins that Maelstrom will deploy excess stables into once the Fed blinks are $ZEC (Zcash) and $HYPE (Hyperliquid). In my next essay, I will present my model for why $HYPE will trade to $150 by July, which is ~5x higher than current levels. Obviously, we are already long $ZEC and $HYPE, but I want moar, and if my AI financial crisis thesis is correct, there will be another opportunity to acquire more of these high-quality shitcoins on sale.

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

[1] GFC - Global Financial Crisis

[2] WTO - World Trade Organization

[3] BLS - Bureau of Labor Statistics

[4] Source - St. Louis Fed

[5] US Federal Deposit and Insurance Corporation

[6] QE - Quantitative Easing

[7] Buffalo Bill Bessent is US Treasury Secretary Scott Bessent.

I usually love your writing albeit ficticious 98% of the time but WTF is this even about?

afternoon Arthur

always enjoy the literature and your vantage

hope the skiing has been great and cheers to these wonderful times

ae